-

Aliko Dangote plans to sell 5–10% of Dangote Petroleum Refinery shares on the Nigerian Exchange within the next year.

-

The refinery aims to expand production to 1.4 million barrels per day, surpassing the world’s largest refinery in Jamnagar, India.

-

Dangote is exploring strategic partnerships with Middle Eastern companies and projects in China while resolving technical issues in refinery operations.

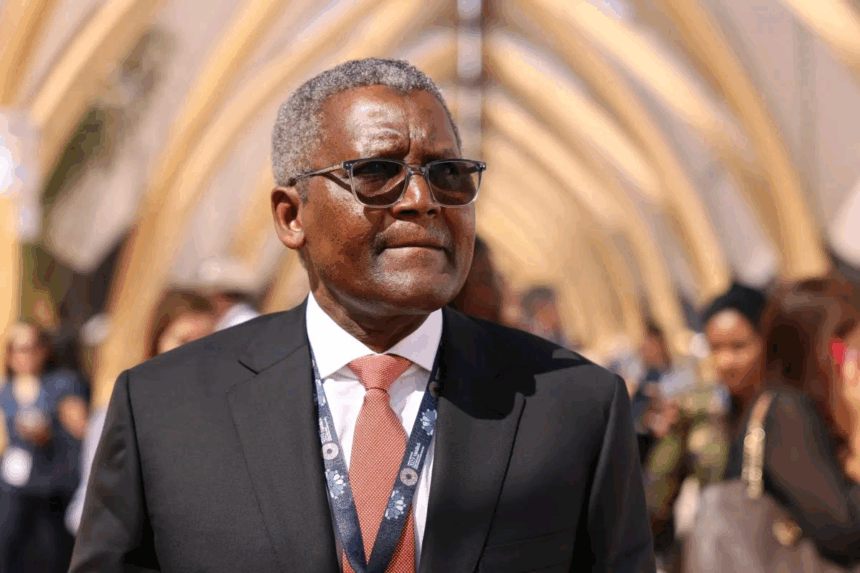

Aliko Dangote, President and founder of Dangote Group, has revealed plans to offer 5–10% of Dangote Petroleum Refinery’s shares on the Nigerian Exchange (NGX) within the next year, mirroring previous strategies used for Dangote Cement and Dangote Sugar Refinery.

Speaking in an interview with S&P Global, Dangote said the share sale would be gradual, depending on investor appetite and market depth, stressing that the company does not intend to retain more than 65–70% ownership.

ATTENTION: Click “HERE” to join our WhatsApp group and receive News updates directly on your WhatsApp!

The industrialist also confirmed ongoing discussions on strategic partnerships with Middle Eastern firms to support the refinery’s expansion and a new petrochemical project in China.

He added that the Nigerian National Petroleum Company (NNPC) Limited might increase its stake from 7.2% in a future phase of the project.

READ ALSO: Dangote Accuses NUPENG of Inflating Fuel Prices with Truck Levies

Dangote further disclosed that the refinery plans to increase output to 1.4 million barrels per day (bpd), surpassing the current world’s largest 1.36 million bpd refinery in Jamnagar, India.

The expansion builds on the earlier plan to raise capacity from 650,000 bpd to 700,000 bpd by year-end.

He highlighted other initiatives, including the development of linear alkylbenzene and base oils projects, and an increase in polypropylene production from 1 million to 1.5 million metric tonnes annually.

On refinery maintenance, Dangote acknowledged that most technical issues with the residue fluid catalytic cracker (RFCC) had been resolved, with a final turnaround scheduled to avoid disruptions during the year-end fuel demand surge.