Since Miriam Olusanya emerged as the Managing Director of Guaranty Trust Bank Limited (GTBank Ltd) in July 2021 under controversial circumstances, the once-leading bank has continued to go deeper into crises and financial losses, with customers and shareholders losing faith and trust in the lender.

More saddening is the fact that despite the naira scarcity menace, the bank has continued to inflict more hardships on Nigerians who had entrusted their resources to them over poor services and fraud.

ATTENTION: Click “HERE” to join our WhatsApp group and receive News updates directly on your WhatsApp!

Worthy of note that GTBank has enjoyed patronage not only on account of its relatively impressive numbers over the years but also its spectacular service orientation and deliberate niche market positioning.

Accordingly, GTBank Plc had been consistent in demonstrating its superiority over its peers in the banking industry. The bank, in addition, had also sustained its position as the highest-valued banking stock before now.

For example, despite the pervasive volatility in the market, GT Bank’s stock grew by 21.06 per cent from N29.20 by January 2, 2020 to N35.35 per share on November 20, 2020. Its profit before tax grew by 587.636% from N34.657 billion in 2008 to N234.095 billion by 2020.

At the same time, total asset also grew by 437.174% from N920.493 billion in 2008 to N4.944 trillion in 2020. And at the end of the same 12-year span, its net interest income jumped by 503.999% from N50.311billion in 2008 to N253.668 billion in 2020.

As a result of its successes, many organizations tried to model their operations after GTBank. Its compact disposition appeared to have yielded fruit. Some believe that the bank’s management style had even generated envy among its peers.

Any time there was a comparison among the banks, the argument tended to favour GTBank more. This truly mystified its operations and brand name over the years. This also prompted the likes of the Harvard Business School and Cranfield Business School to, as a result, carry out deep research on the effectiveness and uniqueness of the GTBank brand.

From the early 1990s, the bank had tirelessly set the pace for other Nigerian financial institutions in terms of service quality, product functionality, and excellent customer service.

All these have changed about the GTBank brand with the recent emergence of Miriam Olusanya as the bank’s head honcho. It is now a sour, bitter, frustrating, and nose-diving story.

BUSINESS LIVE reports that the claimed 23 years’ banking experience of Miriam Olusanya has, however, come into doubt over the crumbling fortunes of the bank thereby confirming fears of shareholders and industry who raised eyebrows over the forceful installation and appointment of Olusanya by Segun Agbaje, the immediate-past chief executive officer of the bank and current group chief executive officer of GTBank’s parent company, Guaranty Trust Holding Company Plc (GTCo).

Shareholders blame Seguna Agbaja over Miriam Olusanya

Shareholders had lamented why Agbaje chose Olusanya with less administrative experience and expertise ahead of the array/forays of more competent hands in the bank. They had also expressed worry about how Miriam, who is battling a case of a failed marriage, would be able to manage a big institution such as GTBank.

Recall that the boardroom crisis had erupted in GTBank after Segun Agbaje disengaged three competent executive directors and six general managers, in a shakeup exercise aimed at paving the way for the emergence of his candidate, Olusanya.

Agbaje was said to have backed Olusanya believed to be his close associate ahead of the other most qualified directors in the bank. Competent sources and shareholders had disclosed that Olusanya, who was then in charge of the Wholesale Banking Division of the bank, lacked the adequate experience and technical skill to run the bank.

The three executive directors and GMs who were forced to retire by the Agbaje were said to be seniors to Olusanya.

But in one year, eight months of Olusanya in the saddle, the worries of shareholders and industry watchers have come to stare the bank in its face. This is because the bank has continued to stagger from one crisis to another with billions of naira lost while customers continue to dump the bank over poor services.

Inside sources told BUSINESS LIVE that the GTCo board is beginning to lose faith in Olusanya’s leadership and capacity after she failed to turn the bank’s fortunes around.

Olusanya, who still answers her ex-husband’s name despite being divorced, has not been able to deliver.

READ ALSO: Stakeholders Recommend Global Practices to Sustain Africa’s Energy Sector

GTBank’s woes started as soon as Olusanya took over in July 2021. The bank reported a profit before tax of N151.91bn for the third quarter of 2021 (months after Olusanya took over), representing a 9.23 percent decline from N167.35bn in the same period of 2020.

GTCo said its revenue dropped by 3.46 percent to N214.77bn in Q3 2021 from N222.47bn in the corresponding period of 2020.

Its unaudited financial statements for Q3 2021 filed showed that its earnings per share also dropped to N4.54 from N5.02.

Many depositors of the bank have started dumping their accounts.

The once-superactive digital platforms of the bank are now comatose in some way.

Findings by BUSINESS LIVE revealed that the bank’s internet banking app, ‘GTWorld,’ its Unstructured Supplementary Service Data (USSD) banking platform, *737# Smart Code, are nothing to write home about as customers of the bank have continued to experience difficulties using the services. It’s been frustrating for the customers of the bank.

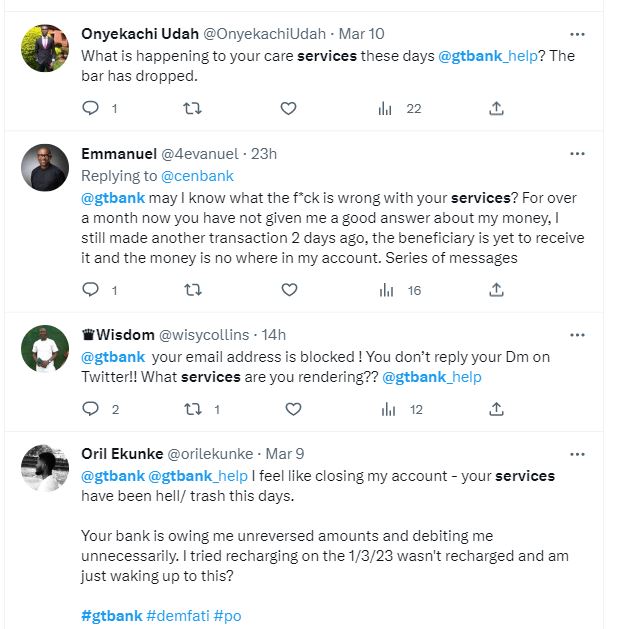

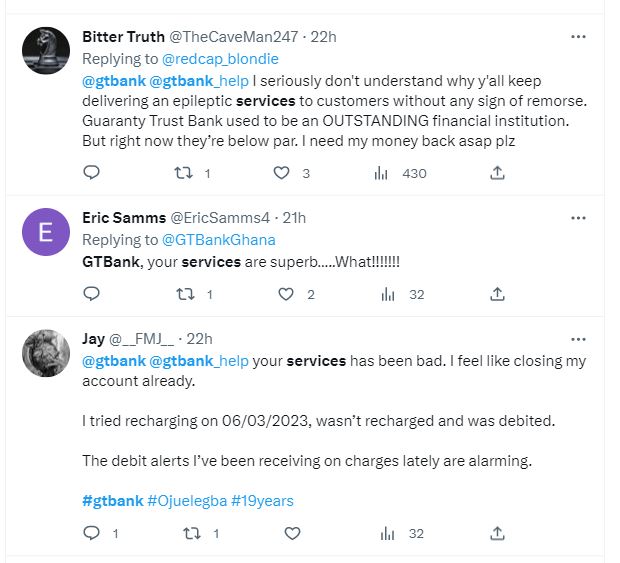

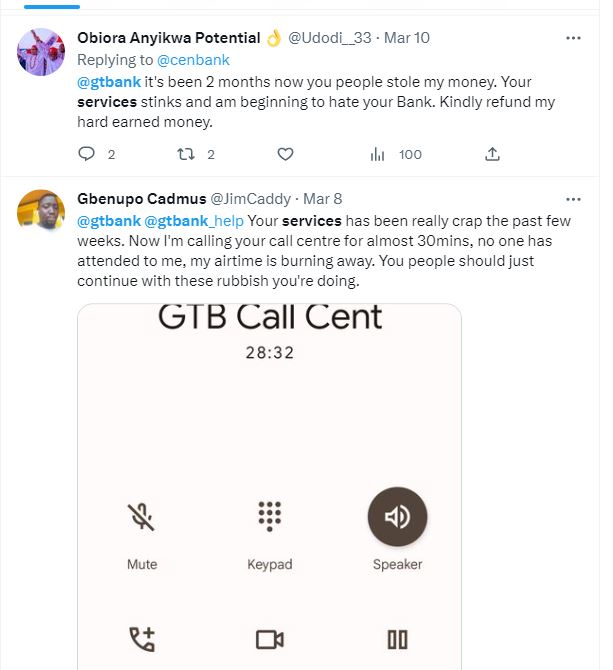

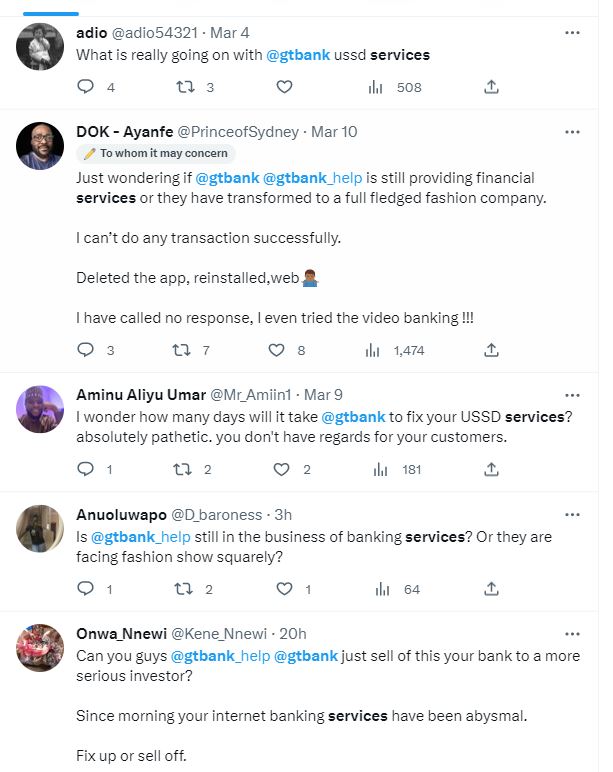

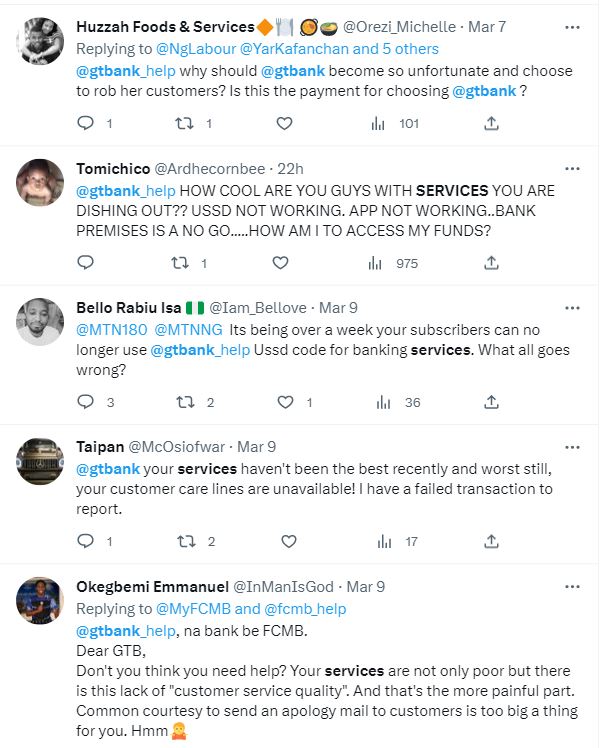

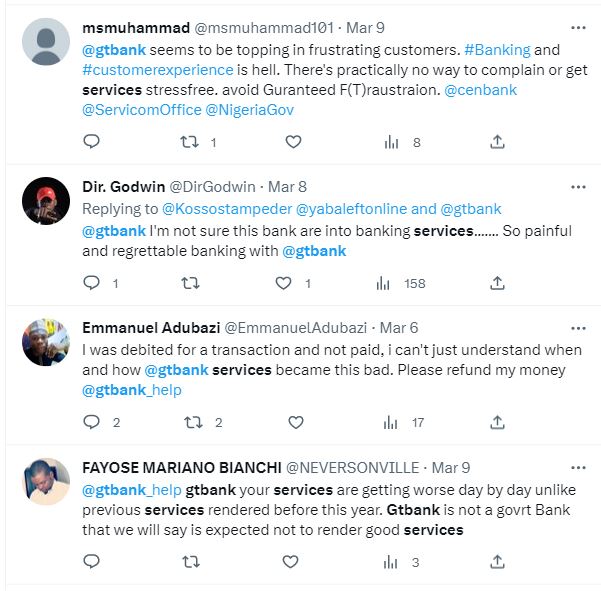

Some frustrated customers of the bank, have, however, taken to the Twitter page to lament the odious hardship imposed on them by GTBank. (SEE POSTS BELOW).

Some shareholders of the bank who spoke to BUSINESS LIVE on the condition of anonymity, however, blamed Segun Agbaje for the bank’s woes for appointing Olusanya. They called on the board to sack Olusanya immediately and bring in a more competent hand to save the bank from imminent collapse.

See screenshots of customers complaining of GTBank’s services