-

No bank account or business can run without Tax ID from January 2026

-

New law links Tax ID to NIN and CAC numbers for easier compliance

-

Defaulters risk sanctions and loss of access to financial services

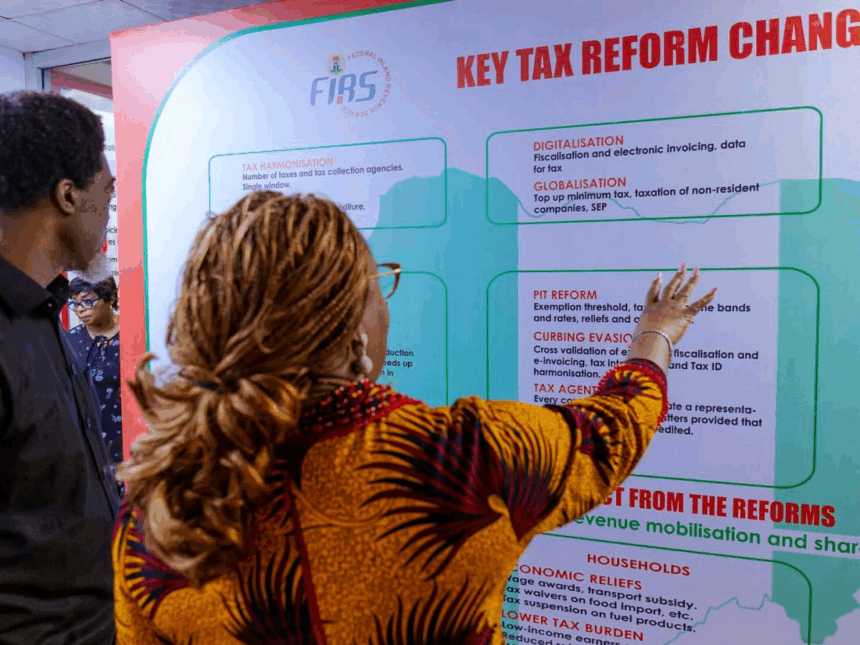

The Nigeria Tax Administration Act (NTAA) has made it compulsory for all taxable persons and businesses in Nigeria to obtain a Tax Identification Number (Tax ID) before January 1, 2026, as a condition for operating bank accounts, pensions, insurance, or investments.

According to the Presidential Fiscal Policy and Tax Reforms Committee, the Tax ID will unify existing TINs issued by the Federal Inland Revenue Service (FIRS), State IRS, and the Joint Tax Board (JTB), with the National Identification Number (NIN) and Corporate Affairs Commission (CAC) registration details serving as the recognised Tax ID.

ATTENTION: Click “HERE” to join our WhatsApp group and receive News updates directly on your WhatsApp!

Officials explained that while the requirement is not new — having existed since the Finance Act 2019 — the NTAA now harmonises and enforces compliance nationwide. Individuals already holding TINs will retain them, while others must register using their NIN or CAC details.

READ ALSO: FG scraps 5% telecom tax on calls, data services

The government clarified that the Tax ID is not a physical card but a unique number issued free of charge, obtainable online or at FIRS, State IRS, or JTB offices. Nigerians in the diaspora will also be required to obtain the number to operate financial services in the country.

Foreign companies doing business in Nigeria must comply with the new law. The Act further mandates all ministries, departments, agencies, and government-owned enterprises at federal, state, and local levels to register and obtain Tax IDs.

READ ALSO: FG scraps 5% telecom tax on calls, data services

Under Section 5 of the NTAA, failure to comply by January 2026 will lead to denial of access to banking and financial services, alongside statutory penalties.

The Federal Government said the move will close loopholes, simplify identification, reduce duplication, and promote fairness by ensuring everyone who earns taxable income contributes their due share, while protecting low-income citizens who are not taxable.