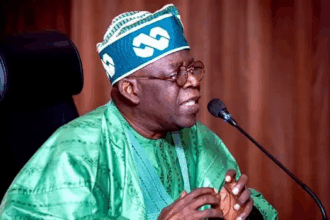

Stock Market Records N1.5trn Gain After Tinubu’s Inauguration

The equities market of the Nigerian Exchange opened trading for the week on a bullish note driven by investors’ confidence, following the inauguration of President Bola Tinubu.

Tinubu, in his inaugural speech, said on Monday that the former administration did not capture fuel subsidy in the 2023 budget and he would ensure a unified exchange rate as part of measures to boost the Nigerian economy.

ATTENTION: Click “HERE” to join our WhatsApp group and receive News updates directly on your WhatsApp!

Specifically, the market capitalisation recorded a gain of N1.505 trillion or 5.22 per cent to close at N30.349 trillion from N28.844 trillion posted on Friday.

Also, the All-Share Index rose by 2,764.47 points or 5.22 per cent to settle at 55,738.35 compared with 52,973.88 recorded at the previous trading.

Accordingly, the Year-to-Date gain moderated to 8.76 per cent.

READ ALSO: Tinubu Clarifies When Subsidy Removal Will Take Effect

Index heavyweights, MTN Nigeria, Dangote Cement and BUA Cement drove the market’s strong performance, alongside gains in Tier- one banking stocks such as Guaranty Trust Holding Company, Access Holdings, United Bank for Africa and Zenith Bank.

Access Holdings in the shares of Transcorp topped the most traded chart with 199.62million shares valued at N2.45 billion.

GTCO followed with 76.38 million shares worth N2.18 billion, while Zenith Bank traded 66.13 million shares valued at N1.92 billion.

UBA traded 81.99 million shares valued at N831.47 million, while Transcorp transacted 95.68 million shares worth N309.24 million.

Analysts at Vetiva Securities Ltd., said that “The market exhibited a favorable response to President Tinubu’s inauguration speech and his proposed plans for the country’s economy.

TRENDING: Tribunal Admits US Court Judgment on Tinubu’s Drug Case as Evidence

“This positive sentiment is anticipated to endure in the upcoming session, as investors responded positively to the latest transition of power to the new administration.”

Market breadth closed positive at with 54 advancing stocks that outnumbered four declining ones.

Zenith Bank recorded the highest price gain of 10 per cent to close at N29.70, per share.

Transcorp Hotels and Nigeria Breweries followed with a gain 10 per cent each to close at N8.25 and N42.35, per share respectively.

Jaiz Bank and First City Monument Bank also went up by 10 per cent each to close at N1.10 and N4.62 per share respectively.

On the other hand, Ikeja Hotel led the losers’ chart by 10 per cent loss to close at N2.16, per share.

NCR followed with a 9.88 per cent decrease to close N2 .76, while Tantalizer dropped by eight per cent to close 23k, per share.

Subsidy Removal: NNPC Throws Weight Behind Tinubu

Julius Barger followed with a decline of 7.94 per cent to close at N29, while International Energy Insurance was down by 6.98 per cent to close N1.20 per share.

Analysis of today’s market activities showed trade turnover settled higher relative to the previous session, with the value of transactions up by 106.07 per cent.

A total of 1.08 billion shares valued at N15.80 billion were exchanged in 9,916 deals.

NAN