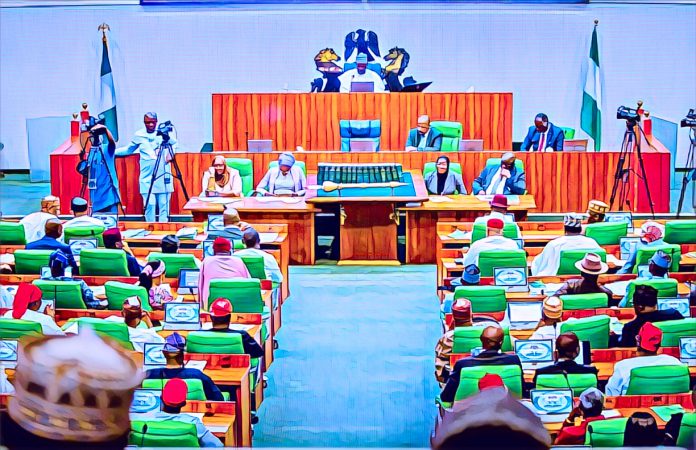

- The House of Representatives is investigating reports of arbitrary and excessive bank charges by Nigerian banks, calling for transparency from the CBN.

- Lawmakers urged the CBN to publish a simplified list of approved bank charges to help protect customers from unfair deductions.

- The probe follows a motion sponsored by Tolani Shagaya, who warned that the practice could erode public trust in the financial system.

- The investigation aims to ensure accountability, fairness, and restore confidence in Nigeria’s banking sector.

Lawmakers have launched an investigation into what they described as “arbitrary and excessive” deductions from customers’ accounts by Nigerian commercial banks.

The move comes amid growing complaints from citizens over unexplained charges on their savings and current accounts.

ATTENTION: Click “HERE” to join our WhatsApp group and receive News updates directly on your WhatsApp!

The House of Representatives has called on the Central Bank of Nigeria (CBN) to publish a detailed list of all approved bank charges and impose sanctions on any bank violating the rules. This directive followed the adoption of a motion of urgent public importance moved by Hon. Tolani Shagaya from Kwara State on Tuesday, October 14.

READ ALSO: FG Finalises N4 Trillion Bond Plan to Settle GenCos’ Debts

The motion, titled “Need to Curb Arbitrary Bank Charges and Protect Nigerian Customers,” highlighted how several banks continue to make unexplained deductions from customers’ accounts, leading to frustration among Nigerians.

Shagaya warned that such unregulated deductions could undermine public confidence in the financial system and discourage people from saving their money in banks.

“These incessant charges have become not only a source of frustration but also a barrier to financial inclusion,” he said. “When people lose trust in the banking system, it weakens the government’s vision for a strong, digital, and cashless economy.”

The lawmaker also pointed out examples of questionable deductions such as excessive SMS alert fees, card maintenance costs, account maintenance fees, and interbank transfer charges.

After deliberations, the House urged the CBN to ensure stricter compliance and to take disciplinary action against erring banks. Lawmakers emphasized that transparency is key to protecting consumers and ensuring fairness in financial transactions.

According to the CBN’s approved guidelines, the 10 most common bank charges include:

- Electronic Money Transfer Levy: ₦50 is charged on transfers of ₦10,000 or more.

- ATM Withdrawal (Other Banks): ₦100 per ₦20,000 withdrawal, up to ₦500 for off-site ATMs.

- Card Maintenance Fee: ₦50 quarterly for naira cards, $10 yearly for foreign cards.

- Account Maintenance Fee: ₦1 per ₦1,000 for debit transactions.

- SMS Alerts: ₦4 per transaction.

- Debit/Credit Card Issuance or Renewal: ₦1,000 per card.

- Cashless Policy (Individuals): 2% on deposits above ₦500,000, 3% on withdrawals.

- Cashless Policy (Corporate Accounts): 3% on deposits above ₦3 million, 5% on withdrawals.

- PoS Charges: ₦100 for cash withdrawal or deposit, ₦50 for transfers.

- Bill Payment via e-Channels: Maximum of ₦500 or 0.75% of the transaction value, whichever is lower.

READ ALSO: Tompolo Donates ₦10 Billion to Delta Security Trust Fund, Strengthens Peace Drive

Recently, data from the Nigerian Exchange (NGX) showed that total customer deposits across 10 major commercial banks rose to ₦140.97 trillion as of December 2024, a 51% increase compared to ₦93.5 trillion in 2023.

Despite this growth, lawmakers insist that protecting customers from arbitrary charges is crucial for sustaining trust and promoting financial inclusion in Nigeria’s banking sector.